Is it always a good idea to have umbrella insurance when I am in New York?

Read MoreIs it always a good idea to have umbrella insurance when I am in New York?

Read MoreIs it always a good idea to have umbrella insurance when I am in New York? Read MoreIs it always a good idea to have umbrella insurance when I am in New York?

Read MoreIs it always a good idea to have umbrella insurance when I am in New York? Read MoreResidential Flood Insurance Claims Process Steps

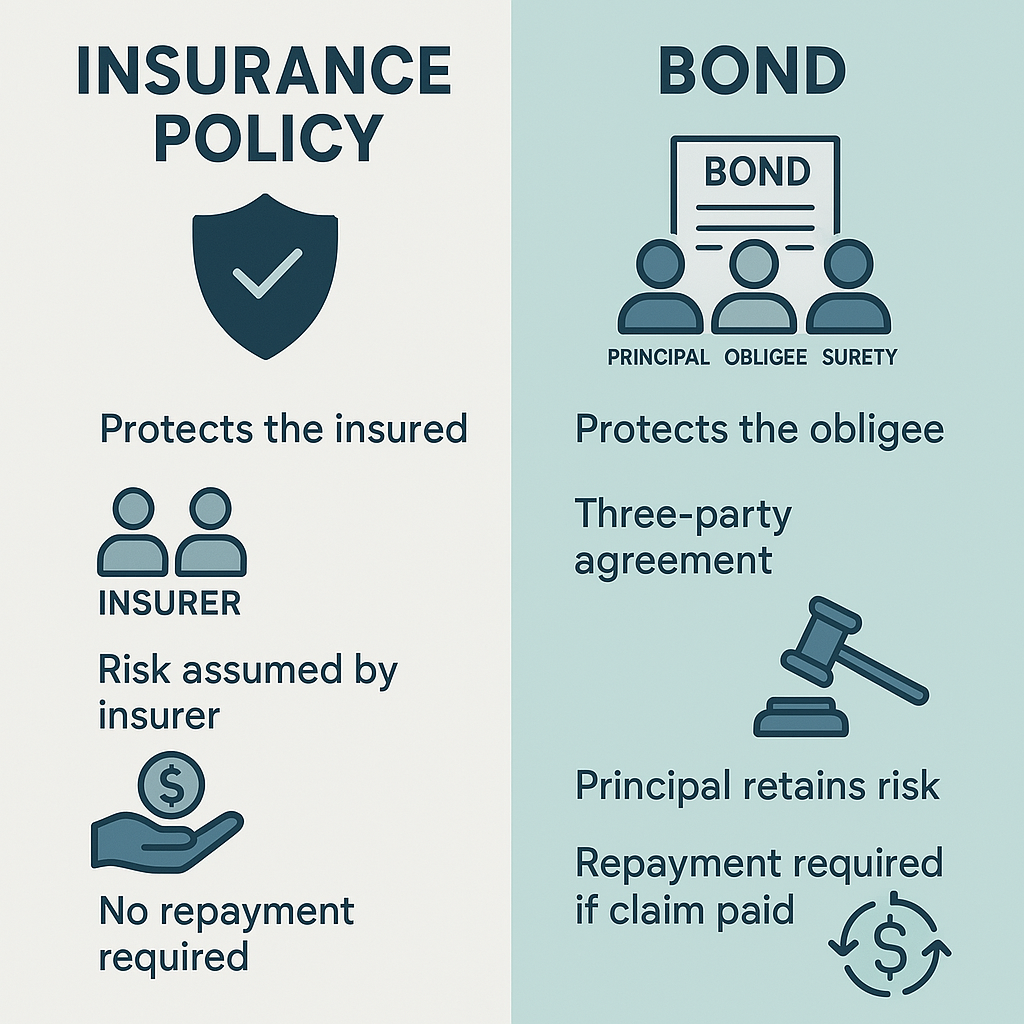

Read MoreResidential Flood Insurance Claims Process Steps Read MoreWhat are the differences between an Insurance Policy and a Bond?

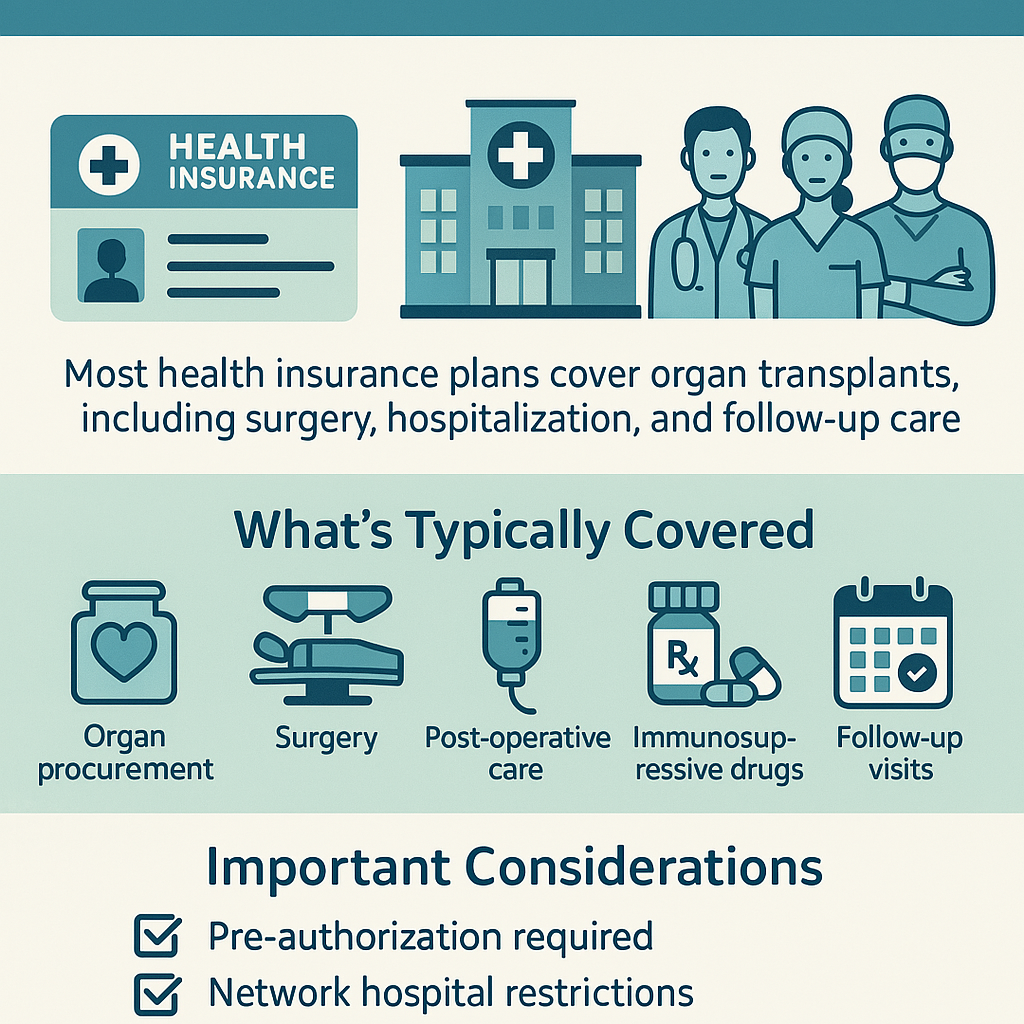

Read MoreWhat are the differences between an Insurance Policy and a Bond? Read MoreHealth Insurance and Organ Transplants

Read MoreHealth Insurance and Organ Transplants Read MoreWhat Your Teen Needs to Know About Auto Insurance

Read MoreWhat Your Teen Needs to Know About Auto Insurance Read MorePrioritizing Coverage Over Price When Insurance Shopping

Read MorePrioritizing Coverage Over Price When Insurance Shopping Read MoreNavigating Insurance Rate Increases: A Comprehensive Guide

Read MoreNavigating Insurance Rate Increases: A Comprehensive Guide Read MoreThe Essential Role of Independent Insurance Agents

Read MoreThe Essential Role of Independent Insurance Agents Read MoreSlipped, Tripped Broke His Hip (Or Did He?)

Read MoreSlipped, Tripped Broke His Hip (Or Did He?)