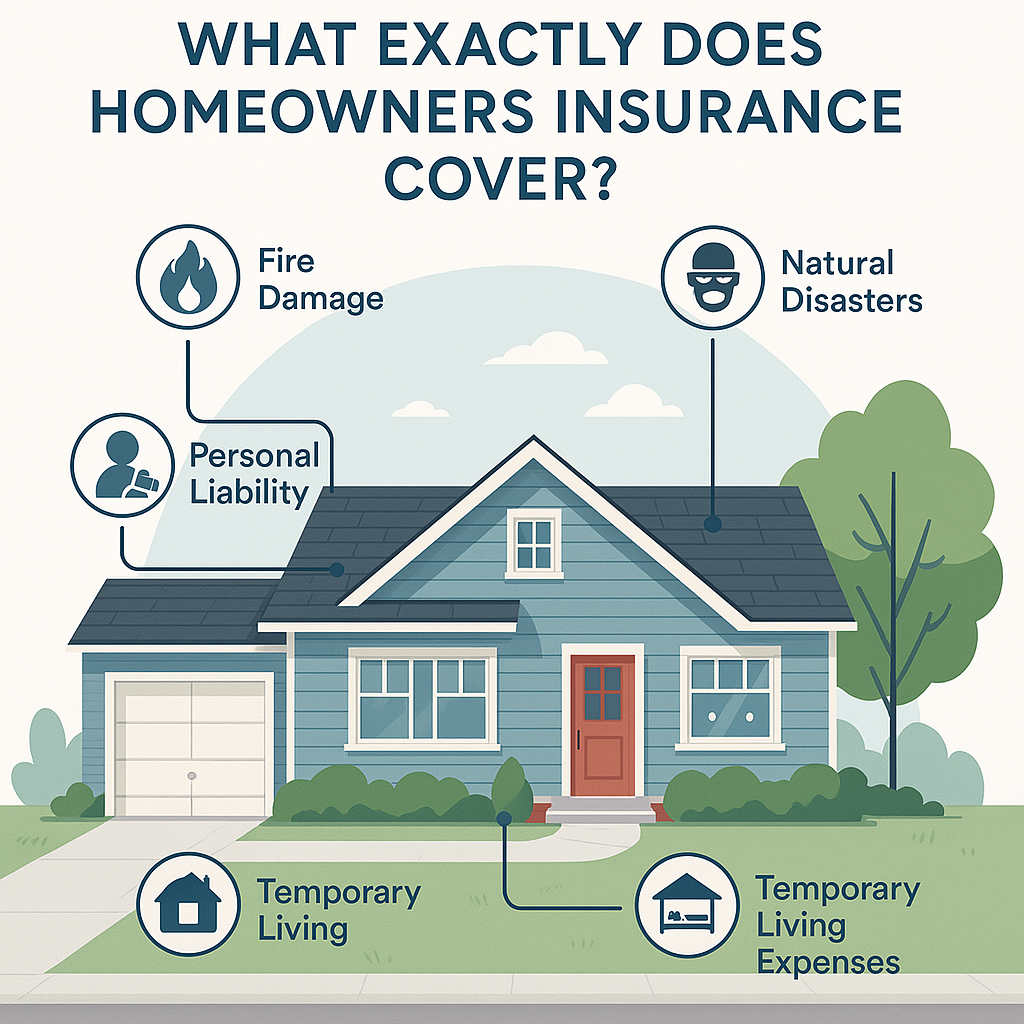

What Exactly Does Homeowners Insurance Cover?

Read MoreWhat Exactly Does Homeowners Insurance Cover?

Read MoreWhat Exactly Does Homeowners Insurance Cover? Read MoreWhat Exactly Does Homeowners Insurance Cover?

Read MoreWhat Exactly Does Homeowners Insurance Cover? Read MoreProtecting Your Home and Assets: The Importance of Insurance During Natural Disasters

Read MoreProtecting Your Home and Assets: The Importance of Insurance During Natural Disasters Read MoreShould I Add Towing to My Auto Policy?

Read MoreShould I Add Towing to My Auto Policy? Read MoreNavigating Uncharted Waters: The Transformative Challenges in the Auto Insurance Landscape

Read MoreNavigating Uncharted Waters: The Transformative Challenges in the Auto Insurance Landscape  Read MoreHosting a Party? Know Your Liabilities

Read MoreHosting a Party? Know Your Liabilities Read MoreOff-Road Adventures Covered: Recreational Vehicle Insurance for ATVs and Dirt Bikes

Read MoreOff-Road Adventures Covered: Recreational Vehicle Insurance for ATVs and Dirt Bikes Read MoreThe Rise of Electric School Buses

Read MoreThe Rise of Electric School Buses Read MoreInsuring Millennials and Gen-Z: Why It’s More Important Than You Think

Read MoreInsuring Millennials and Gen-Z: Why It’s More Important Than You Think Read MoreInsuring Your Safety in Uber and Lyft

Read MoreInsuring Your Safety in Uber and Lyft