We live in a digital age—one where technology connects us to the world, makes life more efficient, and even provides entertainment on demand. But is all this convenience worth it? As we embrace the endless possibilities technology offers, we may be unknowingly sacrificing important parts of our well-being. Technology is a double-edged sword, enhancing our lives while also threatening our mental, physical, and social health.

In this blog, we’ll dive into how our relationship with technology might be diminishing our quality of life—and what actionable steps you can take to reclaim balance in a hyper-connected world.

The Mental Health Toll: Constant Connectivity Equals Constant Stress

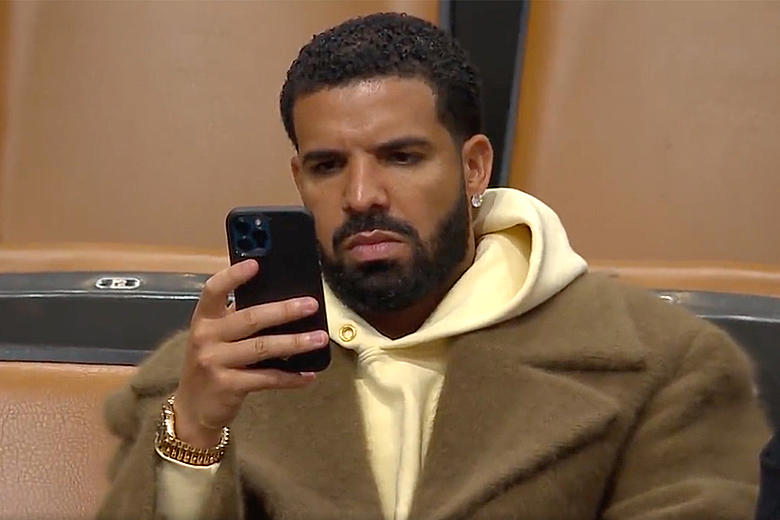

Ever feel like your phone is glued to your hand? You’re not alone. Studies show that constant notifications, endless emails, and the pressure to stay “on” all the time are taking a serious toll on our mental health. While technology allows us to be more connected than ever, it also keeps us tethered to the world in ways that can feel overwhelming.

Social media, for example, encourages comparison, contributing to anxiety and depression. The truth is, when you scroll through feeds filled with curated highlights of everyone else’s life, it’s easy to feel inadequate. Technology also keeps us in a constant state of “information overload,” which can cause burnout and difficulty focusing on meaningful tasks.

What You Can Do:

Set boundaries with your technology. Try scheduling tech-free hours or even entire days to reconnect with yourself and your loved ones. This simple act of digital detox can significantly reduce stress and improve your overall mental well-being.

Tech Neck, Eye Strain, and Sedentary Lifestyles: Our Bodies Are Paying the Price

Technology isn’t just impacting our mindsets, it’s affecting our bodies, too. “Tech neck,” eye strain, and the toll of sedentary living are all consequences of our screen-heavy lifestyles. How many of us have spent hours hunched over our phones or computers, only to realize we’re in pain later?

Long-term screen use can cause chronic neck and back pain due to poor posture, not to mention the damage to our eyes from prolonged exposure to blue light. Add to that the growing issue of a sedentary lifestyle, where we spend more time sitting than moving, and it’s no surprise that we’re experiencing more physical ailments than ever before.

What You Can Do:

Take frequent breaks—every 30 minutes—by standing, stretching, or even taking a short walk. Invest in ergonomic furniture and use blue light filters to reduce eye strain. It’s time to give our bodies the care they deserve.

The Erosion of Real Connections: Are We Losing Our Social Skills?

In a world that’s more “connected” than ever, we’re becoming increasingly isolated. Technology has enabled us to talk to people across the globe, but it has also made us forget how to connect face-to-face. Sure, we may have hundreds of friends on social media, but how many are actual, in-person relationships?

Studies show that loneliness is a growing epidemic, with digital interactions often replacing meaningful real-world connections. Even when we are physically with others, the temptation to check our phones or scroll through social media can prevent us from fully engaging in conversations.

What You Can Do:

Make a conscious effort to nurture in-person relationships. Put the phone down during meals, and invest time in activities that involve direct interaction, like joining a group or attending events. Rebuilding face-to-face connections is essential for emotional well-being.

Attention Span: The Distraction Economy and What It’s Doing to Us

How many times have you checked your phone while reading this blog? It’s a habit we’re all guilty of. Technology is designed to keep us hooked—whether it’s through constant notifications, social media updates, or the next video that auto-plays. As a result, our attention spans are shorter than ever. We’re constantly switching from one task to another, leaving little room for deep focus or creativity.

This “distraction economy” has changed the way we work, too. Multitasking is often encouraged, but the truth is, it leads to more mistakes and less meaningful productivity.

What You Can Do:

To regain focus, try using time-blocking techniques or productivity tools that limit your distractions. Designate specific hours for deep work or activities where you disconnect entirely from technology. You’ll be amazed at how much more you can accomplish with undistracted focus.

The Hidden Risk of Over-Reliance on Technology: What Happens When It All Fails?

Technology is powerful, but it’s not infallible. What happens when our devices break down, our data is hacked, or a system crashes? These disruptions can be more than just an inconvenience; they can be catastrophic. For businesses, the cost of downtime can be devastating, and personal data breaches can ruin financial security. Technology might be the backbone of modern life, but we often overlook the potential risks it brings.

What You Can Do:

Backing up your important data, using strong cybersecurity measures, and ensuring your devices are protected is vital. On a larger scale, businesses need to secure their digital infrastructure and ensure they have the right insurance coverage in place—whether that’s cyber liability insurance or business interruption insurance.

How Insurance Can Protect You from Technology Risks

As our lives become more intertwined with technology, the risks associated with digital dependence grow. Whether it’s a cyberattack, data breach, or equipment failure, having the right insurance in place can protect you from these threats.

- For Businesses: Cyber insurance and data breach coverage are becoming essential in today’s world. They provide protection if your business suffers from a security breach, helping cover the costs of lost data and legal fees.

- For Individuals: Personal insurance, such as identity theft protection, can guard against the financial consequences of having your personal information stolen or compromised.

By understanding the risks technology presents, we can take the necessary steps to protect ourselves and our businesses, ensuring that we don’t sacrifice our quality of life in the digital age.

Finding Balance in a Tech-Driven World

While technology undoubtedly enhances our lives, it’s crucial to remain aware of how it impacts our health, relationships, and productivity. The key to a fulfilling life in the digital age is balance—learning how to use technology to our advantage without letting it take over. With mindfulness, proper management, and the right protective measures (including insurance), we can continue to enjoy the benefits of technology while safeguarding our well-being.

LEGAL DISCLAIMER: This communication is for general informational purposes only and does not constitute legal advice. Consult a qualified attorney for guidance on any legal matters.

Decisions should not be made solely based on this content without professional legal counsel. Individual circumstances vary, and only a personal attorney can determine applicability.

The views expressed are those of the individual creators and do not represent ASZ International, Inc. (dba ASZ Associates). Actions taken based on this content are at your own risk, and all liability is disclaimed.

This content is provided “as is” with no guarantees of accuracy, completeness, or reliability. Always verify information and seek legal advice as needed.